Malpractice insurance claims made vs occurrence: Navigating the complex world of professional liability insurance requires understanding the critical difference between claims-made and occurrence policies. These policies offer distinct coverage periods and triggering events, significantly impacting a professional’s protection. Choosing the right policy hinges on factors like industry, practice size, and anticipated risk exposure.

This comprehensive guide delves into the nuances of claims-made versus occurrence policies, providing a clear comparison of their coverage periods, triggering events, and policy implications. We’ll explore real-world scenarios, policy language examples, and considerations for risk management. Whether you’re a seasoned professional or just starting your career, this resource empowers you to make informed decisions about your malpractice insurance.

Understanding Claims-Made vs. Occurrence Insurance

Claims-made and occurrence insurance policies represent two distinct approaches to protecting businesses from liability risks. Understanding the fundamental differences between these policies is crucial for informed decision-making. Choosing the right type of coverage can significantly impact a business’s financial stability and legal posture.The core distinction lies in when a claim is covered. Claims-made policies protect against claims made during the policy period, regardless of when the underlying event occurred.

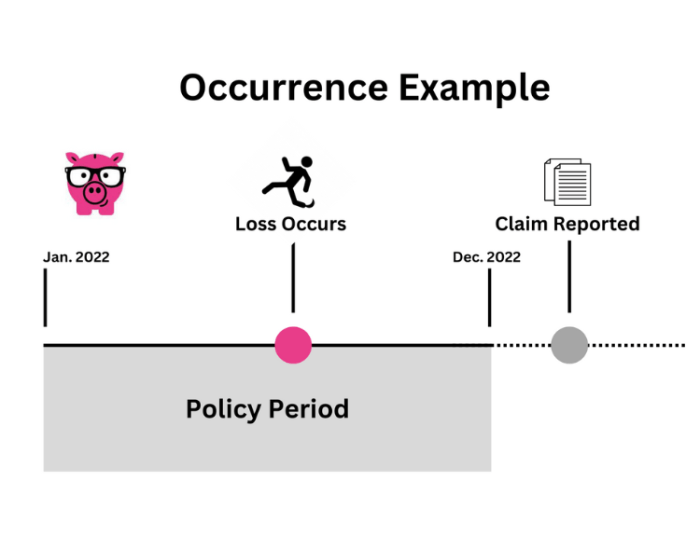

Occurrence policies, conversely, cover claims arising from events that occurred during the policy period, regardless of when the claim is made. This seemingly subtle difference can have profound implications for a business’s insurance strategy.

Fundamental Differences

Claims-made policies provide coverage for claims reported and brought against a business during the policy period. This means that even if a harmful event occurred prior to the policy’s inception, if the claim is filed while the policy is active, coverage may be triggered. Conversely, occurrence policies protect against claims stemming from events that happened within the policy period, irrespective of when the claim is filed.

| Characteristic | Claims-Made | Occurrence |

|---|---|---|

| Coverage Period | The period during which the claim is made | The period during which the harmful event occurred |

| Triggering Event | The date the claim is reported | The date the harmful event occurred |

| Policy Implications | Coverage depends on the policy’s duration, even if the event predates the policy. | Coverage is contingent on the policy’s duration, irrespective of when the claim is filed. |

Historical Context

The evolution of these policies reflects the dynamic nature of legal liability. Early insurance policies were primarily occurrence-based, providing a broader shield against past events. As legal claims became more complex and time-consuming, the claims-made approach emerged, providing clarity regarding coverage boundaries. This shift was driven by the need for greater certainty and predictability within the insurance landscape.

Situational Advantages

Claims-made policies can be advantageous for businesses operating in industries with a high likelihood of long-latency claims, such as medical or legal professions. For example, a medical practitioner might face a claim years after a patient interaction, and a claims-made policy can provide coverage for these situations. Conversely, occurrence policies are often preferred by businesses facing a more immediate potential for claims.

A construction firm, for example, might encounter an accident on a job site that necessitates an immediate claim.

Factors Influencing Policy Choice

Several factors influence a business’s decision between claims-made and occurrence policies. These factors include the industry, the nature of the business’s operations, the potential for long-latency claims, and the specific risk profile of the organization. A business involved in long-term projects or potentially long-term legal issues might prefer claims-made, while a firm with more immediate risks might prefer occurrence coverage.

Coverage Periods and Triggering Events

The temporal scope of coverage in insurance policies, particularly for professional liability, is a critical aspect of understanding risk transference. Claims-made and occurrence policies differ significantly in how they define the period during which a claim is covered, and what event initiates the coverage process. This distinction dictates the potential vulnerabilities and protections offered to the insured.The delineation between these policy types extends beyond mere chronological boundaries; it touches upon the fundamental nature of liability itself.

Occurrence policies offer a more expansive protection, while claims-made policies are often tailored to the specific time frame of the insured’s professional activity. This inherent difference in approach is reflected in the policies’ explicit definitions of coverage periods and triggering events.

Comparison of Coverage Periods

Claims-made policies delineate coverage based on when a claim is reported, while occurrence policies relate coverage to the time of the event giving rise to the claim. This fundamental difference shapes the scope of protection and potential liabilities. Claims-made policies protect the insured against claims arising during the policy period, regardless of when the incident that led to the claim occurred.

Occurrence policies, conversely, offer coverage for claims arising from incidents that happened during the policy period, regardless of when the claim is reported.

Understanding malpractice insurance claims, whether ‘claims-made’ or ‘occurrence-based’, is crucial. A recent review of the Hankook Kinergy ST Touring H735 tyre performance highlights the importance of understanding various factors that influence the cost and coverage of these types of policies. Ultimately, the choice between claims-made and occurrence policies depends on the specific risks and needs of the individual or business.

Triggering Events for Claims-Made and Occurrence Policies

The triggering event for claims-made policies is the formal reporting of the claim, marking the moment coverage begins to apply. The critical moment for coverage is the submission of the claim. Conversely, occurrence policies are triggered by the actual event giving rise to the claim, regardless of when the claim is reported. This difference is vital for understanding when the policy begins to protect the insured.

Impact of Retroactive Dates and Reporting Periods

Retroactive dates and reporting periods are crucial components of both policies. Retroactive dates in claims-made policies determine the earliest incident covered. A retroactive date defines the period when the policy starts to cover events. This is important because claims made after the policy period may not be covered. Reporting periods, also crucial in claims-made policies, are the timeframes within which a claim must be reported.

Understanding malpractice insurance claims, whether ‘claims-made’ or ‘occurrence-based’, is crucial for any professional. A key consideration, particularly for property owners or managers, is how this impacts potential liability, especially in rental situations like those at sofa apartments delray beach fl. Ultimately, the choice between these claim types significantly affects the scope of protection and the potential financial burden in a malpractice scenario.

Claims not reported within the specified period are not covered, even if the incident happened during the policy period. In occurrence policies, the event that triggers the claim is not subject to these restrictions.

Policy Language Example

| Policy Type | Coverage Period | Triggering Event | Retroactive Date | Reporting Period |

|---|---|---|---|---|

| Claims-Made | Policy period | Claim reporting | Often includes a retroactive date, specifying the earliest event covered. | Specified timeframe for reporting the claim. |

| Occurrence | Policy period | Incident date | Not applicable. | Not applicable. |

Potential Gaps in Coverage

Claims-made policies may present a gap in coverage if a claim is reported outside the policy period, regardless of when the incident occurred. Occurrence policies, on the other hand, may expose the insured to claims arising from incidents that occurred before the policy period. Careful review of policy language is essential to mitigate these potential gaps. The insured must carefully consider the limitations and the scope of the protection afforded by each policy type to mitigate potential vulnerabilities.

Policy Language and Implications

The nuanced language of malpractice insurance policies profoundly shapes the coverage afforded to professionals. Understanding the specific terms and their implications is crucial for navigating the intricacies of claims-made versus occurrence policies. This section delves into the policy language, examining key differences, and exploring how these distinctions affect the timing and scope of coverage.

Policy Language Examples

The subtle yet significant differences between claims-made and occurrence policies are often evident in the policy language itself. Here are examples showcasing the contrast:

Claims-Made Policy Example: “Coverage applies only to claims first made against the insured during the policy period.”

Occurrence Policy Example: “Coverage applies to claims arising out of an occurrence during the policy period, regardless of when the claim is made.”

These examples highlight the core distinction: claims-made policies tie coverage to the reporting period, while occurrence policies tie coverage to the event itself.

Critical Policy Terms

Several terms are pivotal in understanding claims-made and occurrence policies. Understanding these terms aids in accurate interpretation.

- Prior Acts: Claims-made policies often exclude coverage for events or incidents that occurred before the policy’s effective date. This is referred to as “prior acts.” The policy explicitly defines what constitutes a prior act and its coverage implications.

- Retroactive Dates: Claims-made policies sometimes include a retroactive date, which extends coverage back to an earlier period. Understanding this date is essential to ascertain the policy’s coverage scope.

- Reporting Periods: The reporting period is a crucial element in claims-made policies. Claims must be reported within a specified time frame to trigger coverage. A failure to meet these reporting requirements can void the coverage.

Common Misunderstandings

Misinterpretations regarding claims-made versus occurrence coverage are frequent. Addressing these misunderstandings is essential for clarity.

- A common misconception is that an occurrence policy provides coverage indefinitely. This is not always the case. Occurrence policies, while not tied to the reporting period, often have limits on coverage, and time limitations, which are not always obvious to the insured.

- Another common misconception is that claims-made policies are always more expensive than occurrence policies. The cost of either policy type depends on various factors, including the type of professional practice, the risk profile, and the coverage limits.

- Insureds may mistakenly believe that the date of the incident triggers coverage under both policy types. This is true only for occurrence policies, not claims-made policies.

Exclusions and Endorsements

Policy exclusions and endorsements can significantly impact coverage under either claims-made or occurrence policies. Understanding these provisions is vital.

- Policy exclusions often target specific types of claims or activities that are not covered. These provisions should be reviewed thoroughly.

- Endorsements are additional provisions that modify the standard policy terms. These can either expand or restrict coverage, and therefore, they should be carefully considered.

Impact on Claims Timing

Policy language dictates the timing of claims. Claims-made policies require claims to be reported during the policy period, while occurrence policies require the incident to occur during the policy period. This difference is fundamental in determining coverage.

Practical Application and Considerations

A nuanced understanding of claims-made versus occurrence malpractice insurance necessitates a practical examination of their application. This scrutiny unveils critical differences in coverage, cost, and suitability across various business contexts. The choice between these policies hinges on the nature of the business, its risk profile, and its specific financial circumstances.

Real-World Scenarios

Claims-made policies are particularly advantageous for businesses with a predictable and controlled risk environment. A consulting firm, for instance, offering services with a clearly defined scope and a limited potential for future claims, finds this model appealing. If the firm has a history of few or no significant incidents, the premium cost can be lower, as the insurer is not burdened by the unknown.

Conversely, a medical practice operating in a high-risk environment or facing the potential for substantial future liabilities is better served by an occurrence policy. In this context, the occurrence policy offers protection against any incident occurring during its coverage period, regardless of when the claim is filed.

Situations Favoring One Policy Over Another

Startups, characterized by their nascent stages and evolving risk profiles, often find claims-made policies more manageable. Their initial liability exposure tends to be limited, and the predictable premiums of claims-made coverage can be more favorable during the early years. Established firms with a proven track record and substantial historical data often benefit from occurrence policies. Their extensive history provides insight into their liability exposure, and the coverage provided by an occurrence policy can be more comprehensive and less contingent on the timing of a claim.

Cost Comparison

Claims-made policies typically have lower premiums than occurrence policies, especially for businesses with limited exposure. This cost advantage stems from the insurer’s focus on claims arising during the policy period. However, occurrence policies provide broader protection and a more stable cost structure, despite higher premiums. The premium difference can be substantial, highlighting the need for a careful evaluation of the risks and the business’s specific circumstances.

Decision-Making Flowchart

| Question | Answer (Claims-Made) | Answer (Occurrence) |

|---|---|---|

| Is the business’s risk profile predictable and low? | Yes | No |

| Is the business’s liability exposure likely to increase significantly in the future? | No | Yes |

| Does the business have a substantial history of claims? | No | Yes |

| Is the business seeking the broadest possible protection, regardless of claim timing? | No | Yes |

| Is the business concerned about the potential for future, unforeseen events? | No | Yes |

| Is cost a primary concern? | Yes | No |

This flowchart provides a simplified guide. Consulting with an insurance professional is crucial for a comprehensive evaluation.

Coverage Disputes

Disputes regarding coverage under malpractice insurance policies can arise from differing interpretations of policy language. Misunderstandings about the policy’s effective period, the definition of a covered event, or the specific triggering conditions are frequent sources of conflict. To address these disputes, parties should thoroughly review the policy wording and seek clarification from the insurer. Mediation or arbitration can be helpful in resolving disagreements, fostering a more amicable and efficient resolution process.

A clear and concise record of communications is essential in documenting the details of the dispute and the efforts made to resolve it.

Risk Management and Prevention: Malpractice Insurance Claims Made Vs Occurrence

Proactive risk management is paramount in mitigating potential financial and reputational damage arising from unforeseen circumstances. A thorough understanding of insurance coverage, coupled with diligent risk mitigation strategies, allows businesses to navigate the complexities of malpractice insurance, thereby ensuring optimal protection. The following sections delve into the practical application of these principles.

Proactive Mitigation of Coverage Gaps

Identifying and addressing potential coverage gaps before they manifest is a critical aspect of robust risk management. This proactive approach necessitates a deep understanding of the specific risks inherent in the business operation and how these risks align with the terms of the insurance policy. Comprehensive due diligence regarding policy limitations and exclusions is vital. Businesses should seek expert guidance when interpreting complex policy language.

Failure to recognize potential gaps can lead to unforeseen liabilities and financial strain.

Thorough Policy Reviews and Understanding Limitations

Regular and thorough policy reviews are indispensable for maintaining an accurate understanding of the policy’s coverage scope. This involves a meticulous analysis of the policy’s language, including exclusions, limitations, and the specific triggering events. Identifying any potential conflicts or ambiguities between the policy and the business’s operational procedures is critical. The review should involve stakeholders from various departments to ensure a holistic perspective.

Insurance Needs Evaluation Checklist

A structured approach to evaluating insurance needs is crucial for ensuring adequate protection. This checklist is intended as a framework for comprehensive assessment, and should be adapted to the specific nature of the business.

- Identify all potential liabilities and risks inherent in the business’s operations, including professional malpractice, negligence, and errors.

- Assess the financial implications of each identified risk, considering potential damages, legal fees, and reputational harm.

- Analyze the current insurance policy to determine its coverage for each identified risk.

- Determine whether the policy’s limits are sufficient to cover potential liabilities. Consider potential increases in risk over time.

- Evaluate the policy’s exclusions and limitations, ensuring a clear understanding of the areas not covered.

- Compare the current policy with industry best practices and competitors’ coverage.

- Document the evaluation findings and recommendations, particularly for areas where the current policy falls short.

Ensuring Accurate Policy Documentation and Record-Keeping

Maintaining accurate policy documentation and meticulous record-keeping is crucial for managing insurance claims and upholding the integrity of the business’s insurance posture. This includes maintaining copies of all policies, endorsements, and amendments. Maintaining detailed records of any communications with the insurance provider, including email exchanges and meeting notes, is also vital. A systematic approach to record-keeping ensures that claims can be processed efficiently and effectively.

Effective Communication with Insurance Providers, Malpractice insurance claims made vs occurrence

Open and effective communication with insurance providers is essential for clarifying policy terms and conditions. This includes seeking clarification on ambiguities, requesting policy updates, and promptly reporting potential claims or incidents. A proactive approach to communication demonstrates a commitment to transparency and accountability, fostering a positive relationship with the insurance provider. Maintaining detailed records of these communications is imperative for any future disputes or claim adjustments.

Closing Notes

In conclusion, understanding the differences between claims-made and occurrence policies is paramount for professionals seeking comprehensive malpractice insurance. This guide has highlighted the crucial distinctions, offering a practical framework for evaluating policy options. Remember, careful consideration of coverage periods, triggering events, and policy language is key to securing appropriate protection. By thoroughly understanding these elements, you can confidently navigate the complexities of professional liability insurance and mitigate potential risks.

FAQ Overview

What are the key differences between claims-made and occurrence policies?

Claims-made policies cover claims reported during the policy period, while occurrence policies cover claims arising during the policy period, regardless of when they are reported. This fundamental difference impacts coverage periods and triggering events.

How do retroactive dates affect coverage?

Retroactive dates in claims-made policies define the earliest period for which coverage applies. Understanding these dates is critical to ensure you have coverage for prior acts.

What factors influence a business’s choice between claims-made and occurrence insurance?

Factors include the nature of the business, the expected length of operations, and the potential for future claims. Startups might lean towards occurrence, while established businesses with a long history might favor claims-made policies.

What are the potential gaps in coverage under each policy type?

Gaps can arise if a claim isn’t reported within the policy’s reporting period or if the triggering event falls outside the coverage period.