Do state employees get health insurance after retirement? This crucial question impacts the financial security of many public sector workers. Understanding the intricate web of state laws, employee contributions, and plan options is essential for navigating the complexities of post-retirement healthcare.

This comprehensive overview explores the nuances of state-sponsored retirement health insurance, examining eligibility criteria, coverage details, and the factors influencing the availability of these vital benefits. From managed care plans to potential limitations, we’ll dissect the various aspects to provide a clear picture of the landscape for retired state employees.

Overview of State Employee Retirement Health Insurance

State employee retirement health insurance varies significantly based on state regulations, the employee’s length of service, and the specific plan chosen. This section provides a comprehensive overview of the general aspects of these benefits, including the common types of plans offered and the potential differences across jurisdictions. Understanding these factors is crucial for employees planning for their post-retirement healthcare needs.

General Aspects of Retirement Health Insurance

Retirement health insurance for state employees is generally designed to provide a transition of healthcare coverage from employment to retirement. This coverage often acts as a bridge, ensuring retirees have access to healthcare while they are no longer employed by the state. However, specific details, including premiums, co-pays, and coverage specifics, are dependent on individual circumstances.

Types of Health Insurance Plans

A range of health insurance plans are typically available to retirees. These plans often include managed care options, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs typically require members to use in-network providers, often with lower premiums, while PPOs offer more flexibility in choosing providers but might have higher premiums and co-pays. Other plans, like point-of-service plans, may blend elements of HMOs and PPOs.

State-Specific Variations

The specifics of retirement health insurance are influenced significantly by the state. Each state has its own regulations and rules governing the programs, affecting the available plans, premiums, and eligibility criteria. For example, some states might offer a wider array of plans, or their plans might have different cost structures. The duration of service is also a key factor, as some states offer more generous coverage based on longer employment periods.

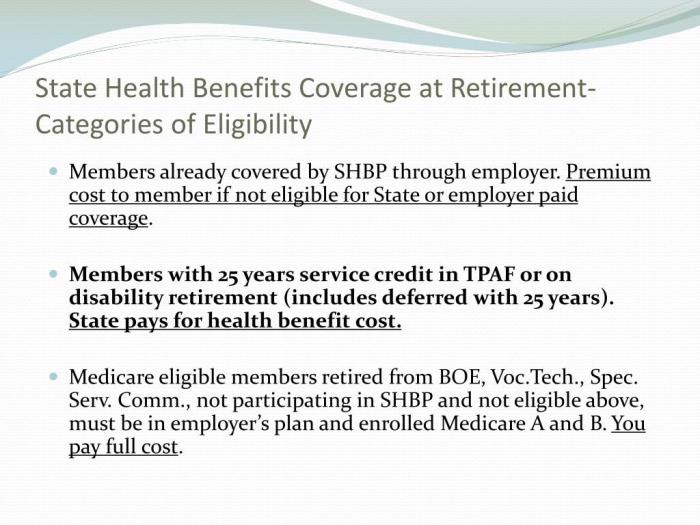

Eligibility Criteria

Eligibility for post-retirement health insurance is typically determined by a combination of factors, such as years of service, retirement age, and in some cases, employee contributions during their employment. Examples of eligibility criteria include minimum years of service requirements, or thresholds for the amount of employee premiums paid.

Comparison of Health Insurance Plans

| Plan Type | Description | Premiums | Coverage | Provider Network |

|---|---|---|---|---|

| HMO | Requires use of in-network providers; often lower premiums. | Typically lower | Usually comprehensive but limited to in-network providers. | Limited to in-network providers. |

| PPO | Offers more flexibility in choosing providers; higher premiums and co-pays are possible. | Typically higher | Broader network of providers, but may have higher out-of-pocket costs. | Wider provider network. |

| POS (Point-of-Service) | Combines aspects of HMOs and PPOs, providing a hybrid option. | Moderate | Offers flexibility and coverage similar to PPOs but may have higher costs if out-of-network care is used. | Combines HMO and PPO network features. |

Factors Affecting Retirement Health Insurance

State retirement health insurance benefits are not a one-size-fits-all proposition. Numerous factors influence whether and how state employees receive health coverage after retirement. Understanding these factors is crucial for employees to make informed decisions about their financial planning and future well-being.The availability and nature of post-retirement health insurance are shaped by various considerations, from state regulations to individual contributions.

This section delves into the key elements that determine the specifics of retirement health insurance for state employees.

State Laws and Regulations

State laws and regulations play a pivotal role in determining the scope and structure of retirement health insurance programs. Different states have varying approaches to funding and administering these benefits. Some states offer comprehensive health insurance coverage, while others may have more limited options or even no post-retirement health insurance at all. The specifics of eligibility, coverage levels, and premium costs are often dictated by these legislative frameworks.

For instance, a state might mandate a specific contribution from employees or employers for post-retirement health insurance, whereas another state might offer a less costly, yet less comprehensive, program funded solely by employer contributions.

Bruh, state workers’ health insurance after retirement is a real question, right? Like, if you’re tryna level up your candy crush game, you might need a sweet deal on candy crush gift card online first. But seriously, finding out if you’re covered after retirement is key. Gotta plan ahead, ya know?

Employee and Employer Contributions

The financial burden of post-retirement health insurance is often shared between employees and employers. The proportion of contributions from each party significantly impacts the cost and availability of coverage. Employees typically contribute a portion of their salary or wages toward the premiums, while employers often cover a significant portion of the cost. This contribution structure influences the affordability and accessibility of the health insurance benefits.

For example, in some states, employees might pay a small monthly premium, while the employer covers the remaining costs, resulting in a more affordable plan. Conversely, other states might have higher employee contributions, leading to a less accessible plan for employees.

Retirement Age

Retirement age often plays a significant role in eligibility for and the level of coverage under post-retirement health insurance plans. Some plans may have different coverage options or premiums based on when employees retire. Employees retiring at a younger age might have different eligibility criteria and potentially lower premiums compared to those retiring later. Furthermore, eligibility requirements might also depend on the length of service with the state.

For example, a state might offer health insurance coverage only to employees who have worked for a certain number of years before retirement.

Different Retirement Plan Options

Various retirement plan options may affect health insurance benefits. The specifics of the plan, including the type of coverage, the contribution rates, and the eligibility criteria, can impact the cost and quality of health insurance coverage. Employees should carefully consider the different options and their individual needs when choosing a retirement plan.

Comparison of Factors Affecting Retirement Health Insurance

| Factor | Description | Impact on Eligibility |

|---|---|---|

| State Laws/Regulations | Legislation governing retirement health benefits. | Determines the existence, scope, and funding of plans. |

| Employee Contributions | Employee’s financial share of premiums. | Affects affordability and accessibility of plans. |

| Employer Contributions | Employer’s financial share of premiums. | Impacts the overall cost and generosity of the plan. |

| Retirement Age | Age at which employees retire. | Can affect eligibility requirements, coverage levels, and premiums. |

| Retirement Plan Options | Various options for retirement plans. | Impacts specific benefits and eligibility. |

Coverage Details and Limitations

Retiring state employees can expect a range of health insurance coverage, but understanding the specific details and potential limitations is crucial for planning. This section will Artikel the typical coverage options and common restrictions associated with post-retirement health insurance plans. Knowing these specifics empowers retirees to make informed decisions about their healthcare needs and finances.

Typical Coverage Options

Retiree health insurance plans typically cover essential medical services, but the specific benefits and levels of coverage may vary depending on the state and the employee’s prior contributions. Commonly covered services include doctor visits, hospital stays, prescription drugs, and mental health services. The details of these coverages are Artikeld in the following table.

Heard state workers gettin’ health benefits after they retire? It’s kinda sus, tbh. But hey, if you’re looking for a sick new way to roll, check out tour code 9 inline skates ! They’re totally fire, and totally worth lookin’ into. Still, the whole retirement health thing is a whole other ballgame, right?

| Coverage Type | Description | Typical Limitations (if any) |

|---|---|---|

| Doctor Visits | Routine checkups, specialist appointments, and consultations. | Potential co-pays, deductibles, and limits on the number of visits per year. |

| Hospital Stays | Inpatient care, including surgeries, diagnostic tests, and recovery periods. | Deductibles, co-pays, and maximum out-of-pocket expenses. Potential limits on the length of stay or specific types of procedures. |

| Prescription Drugs | Medication for various medical conditions. | Formulary restrictions (a list of approved drugs), co-pays, and potentially annual limits on spending. |

| Mental Health Services | Therapy, counseling, and other mental health support. | Potential co-pays, deductibles, and limits on the number of sessions or specific types of therapy. |

Potential Limitations

Understanding potential limitations is essential for effective healthcare planning. These limitations can significantly impact the cost of healthcare and may affect the extent of care retirees can access.

- Deductibles: A set amount the retiree must pay out-of-pocket before the insurance company begins to cover costs. For example, a $1,500 deductible means the retiree is responsible for the first $1,500 of expenses before insurance coverage applies.

- Co-pays: A fixed amount the retiree pays for each doctor visit, prescription, or other service. For instance, a $25 co-pay for a routine checkup means the retiree will pay $25 regardless of the overall cost of the visit.

- Maximum Out-of-Pocket Expenses: A pre-determined limit on the total amount the retiree will pay out-of-pocket during a specific period, such as a calendar year. If the retiree exceeds this limit, they may be responsible for paying 100% of the remaining costs.

Common Exclusions or Limitations

Some services or conditions may not be fully covered or may be excluded altogether from the retiree health insurance plan.

- Pre-existing conditions: Certain pre-existing medical conditions may have limitations or exclusions, or may be subject to higher deductibles or co-pays. This can significantly impact a retiree’s healthcare costs, especially for conditions that require ongoing management.

- Experimental treatments: Treatments or procedures considered experimental or not yet widely accepted may not be covered by the plan. This is particularly relevant for individuals with rare or complex conditions.

- Certain preventive care: While many preventive care services are covered, there might be some exceptions or restrictions.

Examples of Scenarios Demonstrating Limitations

Consider these scenarios to illustrate how limitations can affect retired employees:

- Scenario 1: A retiree with a $1,000 deductible needs a routine checkup and a follow-up appointment with a specialist. The retiree is responsible for the $1,000 deductible before insurance kicks in. The co-pays for both visits will be additional expenses.

- Scenario 2: A retiree has a significant medical emergency requiring a lengthy hospital stay. The maximum out-of-pocket expense limit for the plan is $5,000. If the total cost of the hospital stay exceeds $5,000, the retiree will be responsible for the amount exceeding the limit.

Specific State Examples

State retirement health insurance policies vary significantly, reflecting diverse approaches to employee benefits. Understanding these variations is crucial for employees considering retirement or those already in their post-retirement phase. This section will highlight examples of different state practices, demonstrating the range of options available and the factors that influence these policies.

State-Level Retirement Health Insurance Practices

State governments employ various approaches to providing health insurance to their retired employees. Some offer comprehensive coverage, while others have more limited plans or rely on alternative programs. Understanding these nuances is vital for individuals navigating retirement and benefit eligibility.

| State | Approach to Retirement Health Insurance | Key Characteristics |

|---|---|---|

| California | Generally generous, often with a significant range of options and coverage levels. | Offers multiple plans with varying premiums and benefits, often tied to employee contribution levels during active employment. |

| New York | Offers a comprehensive, multi-tiered system for retirees, often relying on a combination of state funds and individual premiums. | The system frequently involves multiple plan options, potentially with a range of cost-sharing responsibilities for retirees. |

| Texas | Generally more restrictive, often relying on employee contributions and/or a hybrid system. | Premiums and coverage are often significantly higher for retirees. Alternative options like supplemental insurance or other plans may be less readily available. |

| Florida | Offers a system that typically involves a blend of state and employer contributions for retirees, with limited state funding. | The system frequently emphasizes contributions from former employees, often with options that involve varying degrees of cost-sharing and coverage limitations. |

Examples of Generous and Restrictive Policies

California frequently demonstrates a generous approach to post-retirement health insurance, often offering a wide selection of plans with varying premium structures and coverage options, often reflecting contributions made during active employment. In contrast, Texas generally provides a more restrictive approach, frequently requiring substantial employee contributions for coverage. This often leads to higher premiums and potentially less comprehensive benefits for retirees compared to other states.

Understanding these variations is crucial for individuals making decisions about retirement planning.

Detailed Information on a Specific State: California

California’s retirement health insurance system typically offers a range of plans with varying premiums and benefits. These plans often reflect the contributions made during the employee’s active employment. The state frequently works with private insurers to offer these plans, leading to a more diverse selection for retirees. Coverage levels typically depend on factors such as the chosen plan, the employee’s contribution history, and the specific health care needs.

This diversity in options allows retirees to choose a plan that best suits their financial situation and health requirements.

Range of Options Across Different States, Do state employees get health insurance after retirement

The options for post-retirement health insurance vary widely across states. Some states offer comprehensive coverage with a wide array of plans, while others provide more limited options or rely on employee contributions. This demonstrates the significant differences in state-level approaches to employee benefits. The range of options available reflects the diversity in state priorities and approaches to public funding of healthcare.

Employee Rights and Responsibilities

Retired state employees have specific rights and responsibilities concerning their health insurance coverage. Understanding these details ensures a smooth transition and continued access to necessary healthcare benefits. These rights and responsibilities are crucial for maintaining continuity of care and avoiding potential issues.

Rights Regarding Health Insurance Claims and Appeals

Retired state employees have the right to file claims for covered services and appeal decisions regarding those claims. This process typically involves a defined procedure for submitting claims, and for contesting denials or limitations. It’s important to follow the established steps to ensure your claim is processed correctly and any appeals are handled effectively.

Procedures for Renewing or Adjusting Coverage After Retirement

The renewal or adjustment of health insurance coverage after retirement often follows a prescribed process. This involves understanding the deadlines for submitting required paperwork, the necessary documentation, and the appeals process should issues arise.

- Notification of Changes: Retired employees will typically receive notifications regarding changes to coverage, including premium adjustments, benefit limits, or updates to the provider network. These notices provide a clear understanding of any alterations to their existing plans.

- Required Documentation: Specific documents may be needed to maintain or adjust coverage, such as proof of address changes, marital status updates, or dependent information. Ensuring these documents are submitted correctly and on time is essential to avoid disruptions in coverage.

- Deadlines: Deadlines for submitting required paperwork for coverage adjustments, renewals, or appeals are typically Artikeld in the relevant policy documents or employee handbooks. Failing to meet these deadlines may result in the loss of coverage or the inability to make necessary adjustments.

Steps to Make a Claim or Appeal a Decision

Filing a claim or appealing a decision typically involves a multi-step process. Retired employees should carefully review the procedures Artikeld by the state’s retirement system to understand the requirements.

- Claim Submission: The claim should be submitted using the correct form and to the designated department. Completing all necessary sections of the form with accurate information is vital.

- Review of the Claim: The state retirement system will review the claim to determine if the services requested are covered. A response regarding the claim’s approval or denial will be provided within a specific timeframe.

- Appeal Process: If a claim is denied, or if there’s a disagreement with the decision, the employee has a right to appeal. The appeal process involves a clear set of steps that need to be followed meticulously to ensure the appeal is processed properly.

Responsibilities for Maintaining Insurance Coverage

Maintaining health insurance coverage after retirement involves fulfilling certain responsibilities. These obligations ensure the employee’s continued access to the benefits and avoid any potential disruptions in coverage.

- Meeting Payment Obligations: Promptly paying premiums is crucial for maintaining coverage. Failure to do so may lead to the suspension or termination of coverage.

- Providing Accurate Information: Maintaining accurate contact information and promptly reporting any changes in personal circumstances, such as address or marital status, are important responsibilities.

- Understanding Policy Details: Understanding the terms and conditions of the health insurance policy is essential. This includes knowing the covered services, limitations, and any applicable exclusions.

Final Review

In conclusion, state retirement health insurance is a multifaceted issue, varying significantly by state and individual circumstances. Employees must thoroughly understand their specific plan options, potential limitations, and their rights regarding claims and appeals. This analysis provides a crucial framework for understanding the complexities of this important benefit.

Answers to Common Questions: Do State Employees Get Health Insurance After Retirement

What if I change my mind about the retirement health insurance after retirement?

Eligibility and coverage often depend on factors like the employee’s length of service and the specific state’s laws. Reviewing the fine print and contacting the state’s human resources department for specifics is essential.

Are there any exceptions to the retirement health insurance coverage?

Yes, specific situations, such as termination of employment before retirement, may impact eligibility. Refer to the specific state guidelines for details.

How can I find out about my specific health insurance plan after retirement?

Contact your state’s human resources department for details about the specific plan. They will have comprehensive information on the specifics of your plan, including costs and coverage options.

What are the common limitations on post-retirement health insurance?

Limitations often include deductibles, co-pays, maximum out-of-pocket expenses, and specific exclusions, like certain pre-existing conditions. A detailed review of the plan document is recommended.