Breast lift covered by insurance? Understanding insurance coverage for breast lift procedures is crucial for patients considering this cosmetic surgery. This guide explores the intricacies of insurance policies, factors influencing coverage decisions, and the pre-authorization process. We’ll also look at alternatives and case studies, helping you navigate the often-complex world of medical insurance and cosmetic procedures.

This comprehensive resource aims to empower individuals with the knowledge and tools needed to make informed decisions about their breast lift procedure and insurance coverage. From medical necessity to pre-authorization requirements, we provide a clear and concise overview of the process.

Insurance Coverage for Breast Lifts

Insurance coverage for breast lifts, like other cosmetic procedures, can be a total gamble. It really depends on your specific plan and how your insurer views the procedure. Some plans are super generous, while others are more like, “nah, that’s not for us.” It’s a wild ride, but knowing the rules of the game can help you navigate the process.

Different Types of Insurance Plans and Their Approaches to Cosmetic Procedures

Insurance plans are basically different beasts, each with its own way of handling things. Some are health maintenance organizations (HMOs), others are preferred provider organizations (PPOs), and then there are indemnity plans. HMOs often have a network of doctors they prefer, and PPOs give you more flexibility in choosing doctors, but you might have to pay more out of pocket.

Indemnity plans, well, they give you the most freedom but also the most responsibility. Cosmetic procedures, like breast lifts, are often viewed as elective, meaning not medically necessary. This is where things get tricky.

Criteria for Insurance Coverage of Breast Lifts

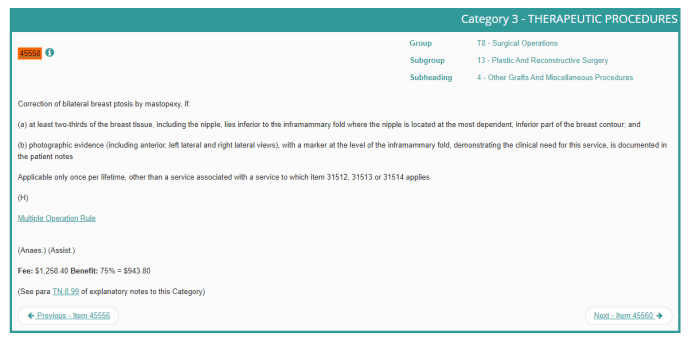

Insurance companies typically use a set of criteria to decide if they’ll cover a breast lift. A common one is whether the procedure is medically necessary to correct a physical issue. If it’s for improving appearance, it’s usually not covered. Things like significant breast asymmetry, severe sagging, or even a prior mastectomy, that’s a different story. They also look at the surgeon’s credentials and whether the procedure follows accepted medical standards.

Examples of Insurance Policies Covering Breast Lifts

Some insurance plans, particularly PPOs with generous benefits, may cover breast lifts if they’re deemed medically necessary. For example, if there’s a significant asymmetry that causes functional problems or a post-mastectomy reconstruction issue, the procedure might be considered medically necessary. However, even with a PPO, the coverage is often limited. It’s crucial to check the fine print of your policy, or ask your insurance provider directly, to see what’s covered.

It’s all about reading the fine print and understanding what the policy actually says.

Comparison of Insurance Providers and Coverage for Breast Lifts

| Provider | Coverage details | Waiting period | Pre-authorization needed |

|---|---|---|---|

| Company A | Covers breast lift for medically necessary reasons, like significant breast asymmetry, but not for cosmetic purposes. | 30 days | Yes |

| Company B | Offers a wider range of coverage, including breast lifts for cosmetic reasons but with significant limitations and high out-of-pocket costs. | 60 days | Yes |

| Company C | Does not cover breast lifts, regardless of the reason. | N/A | N/A |

This table provides a simplified overview. Actual coverage details will vary significantly based on your specific policy and the circumstances of your procedure. It’s important to contact your insurance provider directly to get the most accurate information.

Factors Affecting Breast Lift Coverage

Bro, getting a breast lift covered by insurance can be tricky. It’s not just a simple yes or no; there are tons of factors that play a role. Understanding these factors is key to knowing your chances of getting that sweet, sweet insurance approval.

Medical Necessity vs. Cosmetic Reasons

Insurance companies are usually pretty strict about covering procedures that aren’t medically necessary. A breast lift for purely cosmetic reasons is less likely to be covered. They’re looking for a real medical problem that needs fixing, not just a desire for a different look. Think of it like this: a breast lift to correct severe asymmetry caused by a medical condition is likely to be covered, but a lift to enhance a slight imperfection is less likely.

It’s all about the justification.

Pre-authorization and Insurance Coverage

Getting pre-authorization is a crucial step. This is where the insurance company reviews your request to see if the procedure meets their criteria. They’ll look at your medical history, the reason for the lift, and the surgeon’s recommendation. Without pre-authorization, your insurance might deny the claim, and you’ll end up footing the bill yourself. So, get that pre-authorization squared away early in the process!

Impact of Patient Health Conditions

Certain health conditions can affect insurance coverage decisions. For example, if you have pre-existing conditions that could be exacerbated by the surgery, the insurance company might be more cautious about covering it. A thorough discussion with your doctor and insurance provider is essential to understand the potential implications of any underlying health issues.

Importance of a Clear Medical Necessity Justification

Having a strong justification for the breast lift is paramount. The justification needs to clearly explain how the procedure addresses a medical need, not just a cosmetic concern. The surgeon’s report and your medical records should comprehensively detail the problem and how the lift is the solution. This is where a good relationship with your doctor is vital.

They can help you build a strong case for medical necessity.

Common Reasons for and Against Insurance Coverage

| Category | Reason | Example |

|---|---|---|

| Medical Necessity | Correction of significant breast asymmetry or deformities resulting from a medical condition (e.g., mastectomy, trauma). | A woman underwent a mastectomy and now has significant asymmetry. A breast lift is needed to restore symmetry. |

| Medical Necessity | Reduction of breast size due to a medical condition like fibrocystic breast disease causing significant discomfort and pain. | A woman suffers from fibrocystic breast disease that causes substantial pain and limits daily activities. A breast lift is deemed medically necessary to reduce the size. |

| Cosmetic Enhancement | Enhancement of breast size or shape for purely aesthetic reasons. | A woman wants to enhance the size of her breasts for purely cosmetic reasons. |

| Cosmetic Enhancement | Correction of minor asymmetry that doesn’t significantly impact health. | A woman wants a breast lift to correct a small asymmetry that doesn’t cause pain or discomfort. |

Pre-authorization and Documentation: Breast Lift Covered By Insurance

Getting a breast lift covered by insurance ain’t a walk in the park, man. You gotta navigate the pre-authorization process, and that means knowing what documents your doc needs to send to the insurance company. This part’s crucial, ’cause if the paperwork’s not right, your insurance might reject the claim. So, let’s break down how to make sure everything’s on point.

Pre-authorization Process Overview

The pre-authorization process is basically the insurance company’s way of checking if your breast lift is covered and what the cost will be. They need to make sure the procedure is medically necessary and falls within their guidelines. It’s like a preliminary approval. This step is vital because it often saves you a lot of time and hassle later on.

Preparing Necessary Documentation

To make sure your pre-authorization request flies, you need to provide your doc with the right documents. This includes your medical records, which should show any past breast surgeries or conditions, and any relevant recommendations from your doctor. Think of it as providing a clear picture of your health history to the insurance company.

Example Documentation

Some examples of documents needed for a successful pre-authorization request include:

- Detailed medical history: This should include your past medical records, any surgeries, and any relevant medical conditions.

- Physician’s recommendation letter: This letter should clearly state the medical necessity of the breast lift, explaining why it’s important for your health and well-being. The doc should also detail the specific procedure, expected outcomes, and any alternative treatments considered.

- Imaging reports (if applicable): If your doc has ordered any imaging scans, like mammograms or ultrasounds, these reports are essential to show the current state of your breasts.

- Pre-authorization form: This form is provided by the insurance company and needs to be filled out completely and accurately.

Essential Steps in Pre-authorization

This table Artikels the critical steps in the pre-authorization process:

| Step | Description | Required Documents |

|---|---|---|

| 1. Consult with your physician | Discuss your needs and goals with your doctor, and get the necessary recommendations. | Patient history, doctor’s notes |

| 2. Obtain pre-authorization form from insurance company | Request the form from your insurance company’s website or customer service. | Insurance information |

| 3. Complete the pre-authorization form | Fill out the form accurately and completely. Provide all necessary details. | Completed form, insurance details, medical records |

| 4. Attach required documents | Compile all required documents, including medical records, physician’s recommendation, and any imaging reports. | All medical records, physician’s recommendation, imaging reports |

| 5. Submit the request to insurance company | Send the completed form and supporting documents to the insurance company. | Complete pre-authorization package |

| 6. Await insurance decision | Wait for the insurance company to review and approve or deny the pre-authorization. | Ongoing |

Patient Rights and Responsibilities

Bro, so you wanna get a boob job and your insurance is sayin’ no? It’s a total bummer, right? Knowing your rights and responsibilities can totally level up your chances of getting that coverage. This section’s gonna break down the dos and don’ts, so you’re totally prepared.

Patient Rights Regarding Insurance Coverage

Patients have the right to understand the specifics of their insurance policy, particularly regarding procedures like breast lifts. This includes knowing the criteria for coverage, any pre-authorization requirements, and the appeal process if your claim is denied. It’s your right to ask questions and get clear answers.

Potential Appeals Processes if Coverage is Denied

Insurance companies usually have an appeals process if your breast lift isn’t covered initially. This is often a multi-step process, and you’ve gotta be proactive. Start by reviewing the denial letter carefully, identifying the specific reason for the denial. Then, gather all the supporting documentation, like your medical records, pre-authorization requests, and any relevant information about your health condition.

You can contact the insurance company’s customer service or appeals department to initiate the appeal process. Usually, they’ll provide specific instructions and timelines.

Patient’s Responsibility in Providing Accurate Information and Complying with Insurance Requirements

Dude, you gotta be on top of things. Providing accurate and complete information during the pre-authorization process is super important. This includes providing your medical history, any relevant test results, and other info requested by the insurance company. Following the pre-authorization guidelines is also key. Failing to do so can result in your claim being denied, so be meticulous.

Potential Legal Implications of a Denial of Coverage

A denial of coverage for a breast lift, especially if deemed unreasonable, can have legal implications. The specifics depend on your location and the laws surrounding health insurance. In some cases, you might be able to challenge the denial in court. It’s crucial to consult with a legal professional if you feel the denial is unjustified or discriminatory.

There are some legal loopholes you can explore, especially in cases of clear bias or if the insurance company isn’t following their own policies.

Summary of Patient Rights and Responsibilities

| Right/Responsibility | Description | Example |

|---|---|---|

| Understanding Policy Details | Know the policy’s coverage criteria, pre-authorization requirements, and appeal process. | Asking your insurance provider for a copy of the policy section regarding cosmetic procedures. |

| Initiating Appeal Process | Follow the insurance company’s appeal process if coverage is denied. | Contacting the insurance company’s appeals department to file an appeal after a denial letter is received. |

| Providing Accurate Information | Provide complete and accurate medical information requested during pre-authorization. | Submitting all required medical records and test results for review. |

| Complying with Requirements | Adhere to all pre-authorization guidelines and procedures. | Meeting all deadlines for submitting paperwork and completing necessary steps for pre-authorization. |

Alternatives to Covered Breast Lift Procedures

Duh, so your insurance ain’t coverin’ that breast lift? No worries, Bandung babes! There are still plenty of other options to perk up those boobies without breakin’ the bank or your budget. We’ll explore some non-surgical and surgical alternatives, plus how to get a second opinion.

Non-Surgical Breast Enhancement Options

Non-surgical methods, like fillers, are a great way to temporarily plump up your chest without the big-time surgery. These are often a good starting point or a temporary solution before considering more permanent options. However, results are temporary and can be unpredictable.

- Fillers: These injectables, often hyaluronic acid-based, can temporarily add volume to the breasts. They’re pretty popular because they’re relatively quick and straightforward. However, the results are temporary, usually lasting a few months to a year, and touch-ups are often needed. Also, the effects can vary from person to person, so the outcome isn’t always guaranteed.

- Breast Shaping Bras: These specialized bras can enhance your chest shape and give you a more lifted look. They’re a great temporary solution or even as a compliment to other procedures. They’re super affordable and don’t require any surgery or downtime.

Seeking a Second Opinion

Getting a second opinion from another medical professional is always a smart move, especially if you’re considering a procedure like a breast lift. It can help you feel more confident in your decision and ensure you’re making the best choice for your body. This is crucial, especially if the initial assessment doesn’t quite feel right.

Alternative Procedures and Their Potential Benefits and Drawbacks

If a breast lift isn’t covered, exploring alternatives can save you some serious cash. Here are a few options to consider.

- Breast Implants: These are a more permanent solution than fillers, and the results can be pretty impressive. You can choose different shapes and sizes, but they do require surgery, recovery time, and the possibility of complications. Insurance coverage for implants varies widely, so it’s crucial to check with your provider.

- Fat Transfer: This involves taking fat from one part of your body (like your thighs or abdomen) and injecting it into your breasts. It’s a more natural-looking option than implants, but the results can be less predictable. You’ll need to be prepared for the potential need for multiple sessions, which can increase the overall cost. The results are also less permanent compared to breast implants, as some fat cells can be reabsorbed.

- Augmentation Mammoplasty (with or without a lift): This is a surgical procedure that involves placing implants to increase breast size. It’s a more permanent option compared to fillers and can provide a more substantial increase in breast size. It’s crucial to carefully consider the potential benefits and drawbacks before committing to this procedure, as it involves surgery, recovery time, and potential complications.

Comparison Table of Breast Lift Alternatives

| Alternative | Description | Benefits | Drawbacks |

|---|---|---|---|

| Fillers | Temporary volume enhancement with injectables. | Quick, relatively inexpensive, minimal downtime. | Temporary results, touch-ups needed, unpredictable outcomes. |

| Breast Shaping Bras | Enhance breast shape through specialized bras. | Affordable, no surgery, immediate results. | Temporary solution, limited enhancement. |

| Breast Implants | Permanent augmentation with implants. | Significant enhancement, long-lasting results. | Surgery, recovery time, potential complications, variable insurance coverage. |

| Fat Transfer | Transferring fat to enhance breast volume. | Potentially more natural-looking results, minimal scarring. | Less predictable outcomes, multiple sessions possible, potential for fat reabsorption. |

| Augmentation Mammoplasty | Surgical augmentation with implants. | Significant and long-lasting enhancement. | Surgery, recovery time, potential complications, variable insurance coverage. |

Illustrative Case Studies

Insurance coverage for breast lifts, it’s a tricky thing, man. Sometimes it’s a total yes, sometimes a hard no. It really depends on the specifics of your case, like your health history and the insurance policy itself. Let’s dive into some real-life examples to get a clearer picture.

Case Study: Covered Breast Lift

A patient, let’s call her Ayu, had a breast lift that was totally covered by her insurance. Ayu had some extra skin and sagginess after having kids, and she wanted a breast lift to improve her confidence. Her doctor submitted the necessary pre-authorization forms, providing detailed documentation about her medical history and the reasons for the procedure. The insurance company approved the procedure after reviewing the documentation, as it fell under their coverage guidelines for reconstructive procedures related to post-partum changes.

This was a win-win situation for Ayu.

Case Study: Uncovered Breast Lift and the Reasons, Breast lift covered by insurance

Bambang, another patient, unfortunately, had his breast lift denied by his insurance. The reason? His insurance policy specifically excluded cosmetic procedures, even if they had some reconstructive elements. Bambang’s doctor’s documentation didn’t clearly differentiate the reconstructive elements from the cosmetic ones, which was a crucial miss. It’s a common snag.

While some insurance plans cover breast lift procedures, it’s crucial to check specifics. A delicious treat like a banana pecan caramel layer cake, found in this recipe here , might be a sweeter alternative if the procedure isn’t covered. Ultimately, understanding your insurance policy is key to making informed decisions about cosmetic procedures like breast lifts.

Make sure your doctor’s notes are crystal clear about the medical necessity, not just the desired aesthetic result.

Successful Appeals for Breast Lift Coverage

Insurance companies aren’t always the final say. Sometimes, a polite and well-structured appeal can work wonders. Citra, for example, had her initial request for a breast lift denied. She appealed, providing additional medical documentation and emphasizing how the procedure would improve her overall health and well-being, addressing the potential reconstructive benefits. The insurance company reconsidered and approved her procedure after her compelling appeal.

While some insurance plans cover breast lift procedures, it’s crucial to check your specific policy details. Finding a delicious gluten-free pizza option can be tricky, but thankfully, Hungry Howie’s gluten-free pizza offers a satisfying alternative. Ultimately, understanding your insurance coverage for a breast lift remains a key step in the process.

Illustrative Documentation for Pre-Authorization

Solid documentation is key for getting your breast lift pre-authorized. The crucial documents for successful pre-authorization include detailed medical reports, including patient history, physical examination findings, and the surgeon’s justification for the procedure. Pictures of the patient’s current breast condition and desired outcome, along with the surgeon’s surgical plan and estimated costs, are all essential components of the documentation.

It’s like a mini-case file for your procedure. The more comprehensive and convincing your documentation, the higher the chances of approval.

Case Study: Second Opinion and Coverage

Dewi’s breast lift was initially denied by her insurance. But Dewi wasn’t ready to give up. She sought a second opinion from another surgeon, who provided a fresh perspective and emphasized the medical necessity of the procedure, highlighting the functional improvements and the impact on her overall health. The second opinion, combined with her initial doctor’s documentation, convinced the insurance company to approve the breast lift.

It’s a good strategy, especially if you’re feeling unsure about the initial denial.

Conclusive Thoughts

In conclusion, securing breast lift insurance coverage requires careful consideration of medical necessity, pre-authorization procedures, and potential alternatives. This guide provides a roadmap to navigate the complexities of insurance policies and patient rights. Ultimately, understanding your specific insurance plan and seeking professional guidance are key to a successful outcome.

Questions and Answers

Is a breast lift always considered cosmetic?

No, a breast lift can sometimes be considered medically necessary in cases of significant breast tissue loss due to mastectomy or other medical conditions. A doctor’s assessment is crucial in determining the procedure’s classification.

What are the common reasons for a breast lift being denied coverage?

Common reasons include the procedure being deemed purely cosmetic, lack of a clear medical necessity, or insufficient documentation supporting the need for the procedure.

How long does the pre-authorization process typically take?

The timeframe for pre-authorization varies depending on the insurance provider and the complexity of the case. It’s advisable to inquire about typical processing times with your insurance company.

What if my insurance company denies my pre-authorization request?

If your request is denied, you have the right to appeal. Your insurance company’s appeals process should be followed diligently.